Iran’s parliament voted Sunday to support the closure of the Strait of Hormuz, a vital maritime chokepoint for global oil shipments, in response to a series of US airstrikes on Iranian nuclear facilities. The move, though symbolic for now, has sparked concern across global energy markets and triggered a spike in oil futures ahead of Monday’s trading.

“The closure of the Strait of Hormuz will be our immediate response if aggression continues”, said Iranian parliamentary speaker Mohammad Bagher Ghalibaf, calling the vote “a warning to Washington and its allies”.

What Sparked the Vote?

The vote follows coordinated Usa military strikes on June 21 targeting Iran’s key nuclear sites at Fordow, Natanz, and Isfahan, which US officials say were part of a limited operation aimed at halting uranium enrichment activities.

Iran condemned the action as a violation of international law and vowed to respond “at a time and place of its choosing.”

Why the Strait of Hormuz Matters

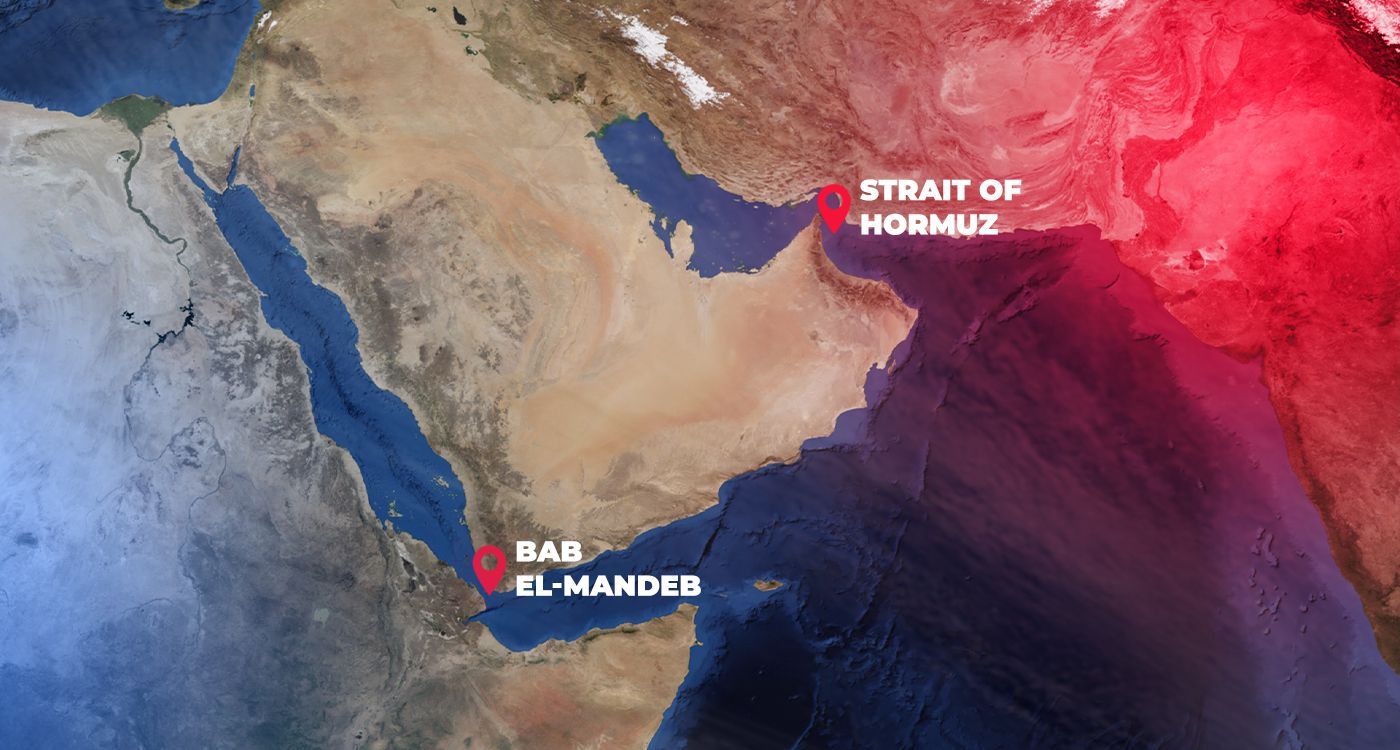

The Strait of Hormuz—just 21 miles wide at its narrowest point—is the most important oil transit chokepoint in the world. Roughly one-fifth of global petroleum and liquefied natural gas (LNG) passes through the narrow waterway daily, linking Gulf states with world markets.

- 20% of global oil supply at risk

- Used by major exporters like Saudi Arabia, UAE, Kuwait, Iraq, and Iran

- Disruption could send crude prices above $100/barrel

USA and Global Reactions

The US Pentagon has not responded directly to the parliamentary vote, but military sources say naval forces in the Persian Gulf are on high alert.

“We are closely monitoring the situation and are fully prepared to ensure freedom of navigation in the region”, a USA Defense Department official told Nuzpost.

The United Nations has urged restraint, warning that any closure of the Strait could “escalate into a regional conflict with global consequences”.

Oil Markets Already Reacting

Oil futures jumped on Sunday night in Asia ahead of U.S. market openings:

- Brent crude rose 4.2% to $80.23/barrel

- WTI crude surged to $76.88/barrel

- Analysts predict further spikes if tensions escalate Monday

“Even the threat of a closure sends shockwaves through the energy market”, said Rabah Arezki, former World Bank economist. “This is a red alert for oil-dependent economies.”

What Happens Next?

Though the vote passed in parliament, the decision to actually close the Strait lies with Iran’s Supreme National Security Council and ultimately, Supreme Leader Ayatollah Ali Khamenei.

Analysts believe Iran may be using the move as a strategic bargaining chip in nuclear negotiations or to rally domestic support amid sanctions pressure.

Meanwhile, the U.S. has increased surveillance around the Strait and is reportedly in talks with allies for a potential international maritime coalition to maintain free navigation.

Key Takeaways for USA Readers

- Gas prices may rise this week if oil volatility continues

- Military tensions in the Gulf could impact markets, defense budgets, and supply chains

- No confirmed blockade yet, but threat alone is enough to rattle global confidence

Subscribe Newsletter of Nuzpost for real-time coverage of this developing story, including live oil market updates, U.S. military response, and diplomatic efforts to avoid escalation.